The Florida condo market is currently undergoing a substantial upheaval, marked by a significant and noticeable increase in condo listings across the state. This trend highlights a growing challenge in selling these properties, despite efforts by sellers to attract buyers by lowering sales prices and offering a variety of incentives.

As the market shifts, it has become increasingly apparent that traditional sales strategies may no longer suffice in this evolving landscape. This article aims to delve deeper into the primary factors and reasons fueling this troublesome trend, exploring the underlying causes and examining the broader implications for condo owners and potential buyers alike. By understanding these dynamics, stakeholders can better navigate the complexities of the current market and make well informed decisions.

Rising HOA / Condo Fees: A Core Issue

A primary concern for many condo owners in Florida is the relentless increase in Homeowners Association (HOA) and condo fees. These fees are not only essential for the maintenance and upkeep of common areas, such as landscaping, pools, and fitness centers, but they also cover the comprehensive management of the HOA / condo community. This includes expenses ranging from legal counsel and accounting services to security and emergency repairs. Despite their essential role, these fees have been steadily rising due to a combination of factors that we will explore further in this discussion.

Insurance Premiums: Spiraling Out of Control

The insurance market in Florida faces a crisis, with property insurance premiums reaching unprecedented heights. Driven by a combination of factors—including a high risk of natural disasters, rising reinsurance costs, insurance companies exiting the market, insurance fraud, aging infrastructure, and regulatory challenges—these rising costs compel insurers to increase rates to cover potential losses. Consequently, both property owners and homeowners associations find it increasingly difficult to afford necessary coverage, forcing some to consider selling their properties.

Property Taxes: Increasing Burdens

Property taxes in Florida have also been on the rise, primarily due to increasing real estate market values. This increase in valuation has resulted in higher taxable values, significantly impacting owners without homestead exemption. This group includes many out-of-state residents who maintain second homes in the Sunshine State, such as 'snowbirds'. For these owners, the tax increases are particularly burdensome, further incentivizing the sale of their condominiums.

Reserve Requirements and Deferred Maintenance

Tightening reserve requirements for condo associations and years of deferred maintenance—often a result of efforts to keep monthly HOA fees low—are now catching up with many communities, especially the older ones. These communities are now faced with the need for substantial repairs and updates, which can be financially daunting without adequate reserves.

Inflation: Adding Fuel to the Fire

Unfortunately, the challenges facing the Florida condo market are exacerbated by the broader economic environment, which includes some of the worst inflationary pressures seen in decades. This inflation not only raises the cost of living but also increases the expenses of maintaining a property. As costs continue to rise, the financial strain on condo owners intensifies, making it even more difficult to manage the ever escalating costs. This inflationary surge, coinciding with other stressors in the market, significantly adds fuel to the fire, further compounding the difficulties faced by many condominium owners.

The Impact on Retirees and Fixed-Income Residents

Retirees and residents on fixed incomes are among those hardest hit by these developments. The rising costs associated with living in a condo—including increased fees, taxes, and insurance premiums—are often unsustainable for those with limited financial flexibility. Consequently, many see no choice but to sell their condos and move to more affordable locations, with some even deciding to leave Florida altogether.

Challenging Market: Buyers Are Steering Clear of Condos

Despite the recent price decreases and creative seller incentives, there remains a downturn in buyer interest, attributed to a confluence of discouraging factors, including:

- Condo Prices: Despite a general slowdown in real estate, condo prices remain stubbornly high.

- Interest Rates: Record-high interest rates have significantly increased the overall cost of borrowing.

- Homeowner’s Insurance: Rising premiums add yet another layer of expense, diminishing affordability.

- High HOA Fees: Prospective buyers are often taken aback by unexpectedly high HOA fees.

- Increase in Cost of Living: Inflation is sharply impacting affordability, making it harder for many to manage their finances.

The combination of high asking prices, steep borrowing costs, and substantial HOA fees presents a daunting financial landscape for prospective buyers. Coupled with the economic uncertainties brought about by inflation, these factors make purchasing a condo an increasingly unattractive option, leading to a stagnated market.

Southwest Florida Condo Market Statistics 2024 vs 2023

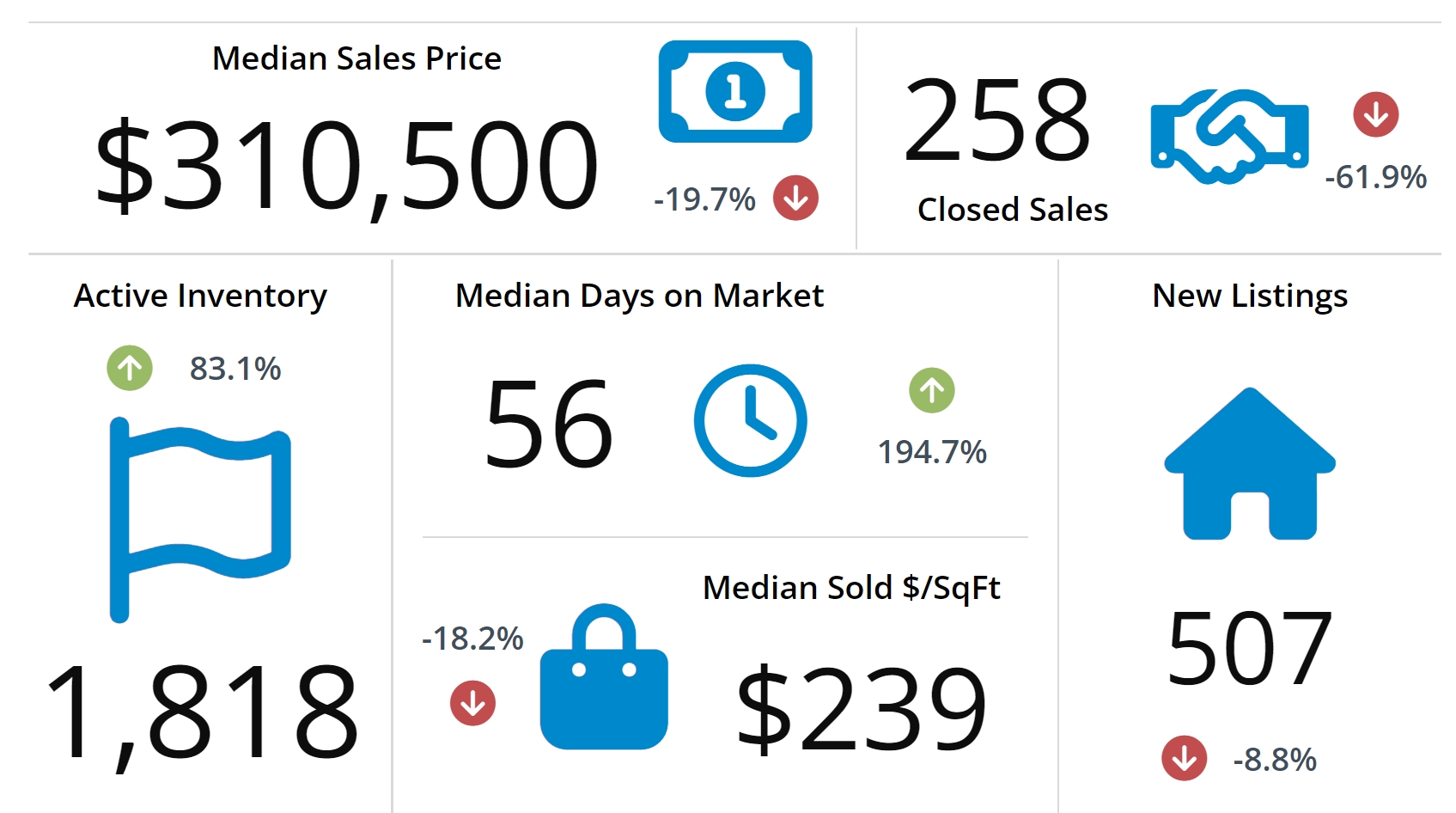

The following chart provides a comprehensive snapshot of the Southwest Florida condo market statistics for April 2024 compared to April 2023, revealing some concerning trends in the local real estate sector:

- Median Sales Price: The median sales price has decreased by 19.7%, indicating a significant drop in property values.

- Closed Sales: There's been a drastic reduction in closed sales, down 61.9%. This steep decline is a clear indicator of waning demand or possible challenges in securing financing.

- Active Inventory: In contrast, the active inventory of condos on the market has surged by 83.1%. This substantial increase points to a glut of properties available, which could be contributing to the falling prices due to higher supply than demand.

- Median Days on Market: Properties are now taking much longer to sell, with median days on the market increasing by 194.7%. This lengthier selling period could deter sellers and may require them to lower prices further to attract buyers.

- Median Sold $/SqFt: The price per square foot has also seen a reduction, down 18.2%. This decrease further reflects the lowering property values across the condo market.

- New Listings: The number of new listings has decreased by 8.8%. Despite the overall increase in inventory, the number of new listings dropping could indicate hesitancy among potential sellers due to less favorable market conditions.

Looking Ahead: No Quick Fixes

Unfortunately, there is no immediate relief or solution in sight for these challenges. The issues affecting the current market situation for condominiums in Florida are complex and intertwined. While the path forward remains uncertain, it is crucial for condo owners, buyers, and HOAs to stay informed and prepare for ongoing changes in the real estate market. Florida residents should urge lawmakers to take further action on affordable homeowners insurance and consider increasing the homestead exemption amounts to help alleviate some of the pressure. Relief cannot come soon enough for those struggling to maintain their homes.