Florida’s property insurance market is in serious turmoil, characterized by soaring premiums, reduced coverage options, and increasing instability. This precarious situation has left homeowners and investors in a challenging position, scrambling to find affordable insurance - if they can find any coverage at all. Many fear the impending reality of exorbitant rate hikes or, worse, cancellation notices just before hurricane season.

Understanding the fundamental root causes of this insurance crisis as well as the impact this instability has on property owners and prospective buyers of real estate is crucial in making informed decisions regarding property insurance coverage in Florida. Despite legislative efforts, the exodus of major insurers from the market has only deepened the turmoil, with premium costs reaching new heights.

The Causes of the Insurance Crisis

- High Risk of Natural Disasters: Florida's geographical location makes it extremely vulnerable to hurricanes and tropical storms. The high frequency and cost of claims from these disasters, particularly hurricanes, are primary drivers of rising insurance costs. These severe weather events have underscored the substantial financial risks insurers face in the state.

- Escalating Reinsurance Costs: Insurance companies also purchase insurance, known as reinsurance, to mitigate their own risk exposure. However, the costs of reinsurance have escalated due to a variety of factors. These increased reinsurance expenses are then passed on to the carriers' customers, primarily homeowners, further exacerbating the cost surge in Florida's property insurance market.

- Insurers Exiting the State: As highly rated insurance carriers (those rated 'A' or higher for financial health and reliability) continue to exit Florida, they are generally being replaced by new entrants with lower ratings (typically 'B' or below). This lower rating indicates an insurer’s weaker financial footing and consequently is raising serious concerns about their ability to pay claims, especially after a disaster such as a hurricane.

- Rampant Insurance Fraud and Litigation: The state of Florida also contends with high rates of insurance fraud (one example being the Assignment of Benefits) and a litigious environment concerning claims. This leads to significant legal and administrative costs for property insurance companies, which are then passed on to consumers via higher premiums. The high rate of litigation and fraud only intensifies the instability within the state’s insurance sector.

- Aging Infrastructure: Many of Florida's residential properties are older and not built to the latest industry standards that much better withstand severe weather. This older infrastructure is more susceptible to damage, posing a higher risk to insurers. The potential for damage from even minor storms necessitates higher premiums to cover these risks.

- Regulatory and Legislative Challenges: Despite several legislative attempts and bills passed to ease the insurance crisis, these efforts have not produced the desired effects. Efforts to stabilize or subsidize insurance costs can unintentionally discourage new insurance companies from entering the market or limit the coverage existing insurers are willing to offer. These challenges contribute to further straining the already volatile market.

The Effects on Property Owners in Florida

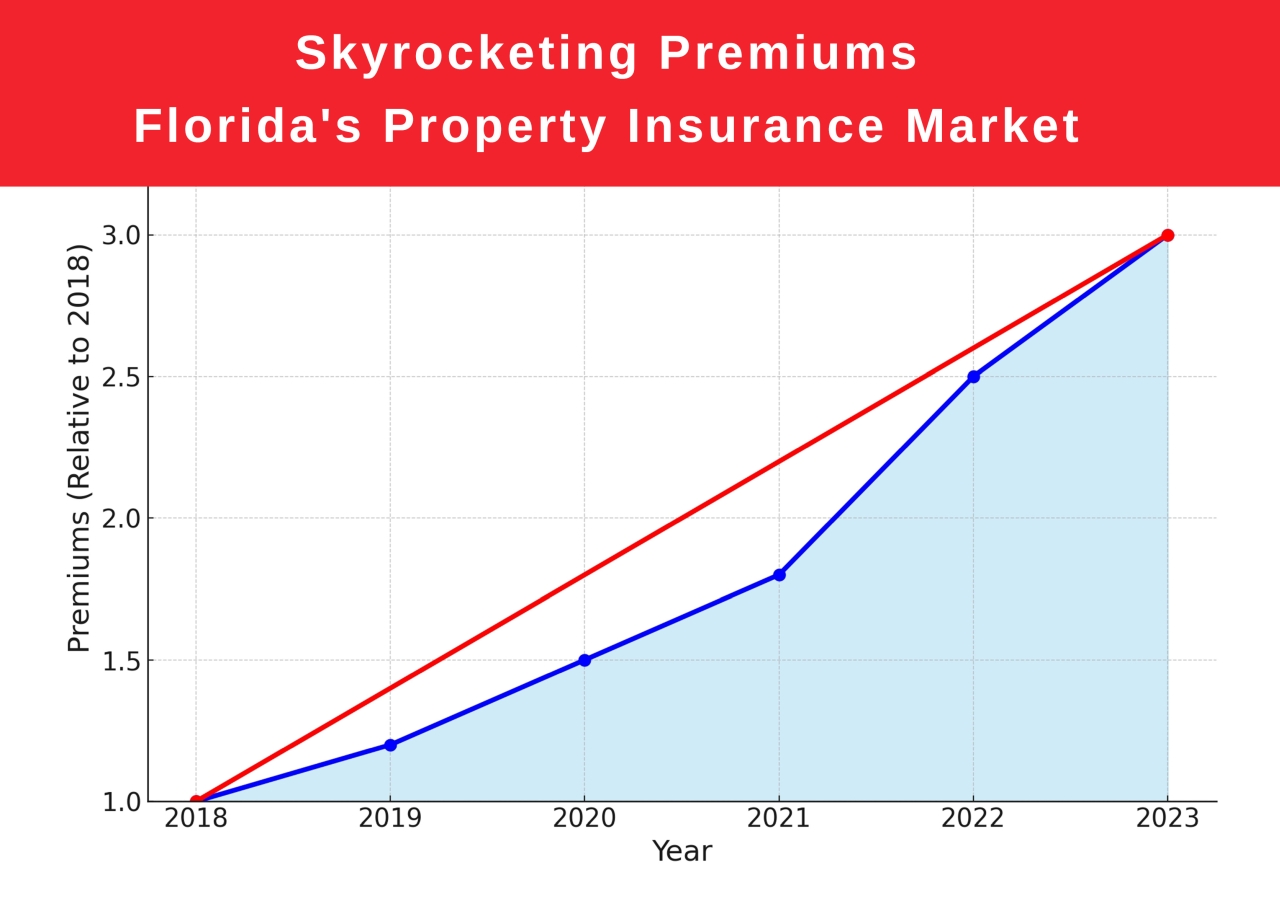

Many property owners in Florida are experiencing severe sticker shock as their insurance premiums double or even triple - that is if they can even find a company willing to insure them. This drastic increase threatens the sustainability of homeownership and forces some to make tough choices. As insurers continue to raise premiums and issue non-renewal notices to their customers, many are finding themselves without coverage, compelled to either sell their homes or face the prospect of going without insurance - an unacceptable situation for most.

For homeowners with a mortgage, property insurance is mandatory, not optional. Those who can no longer afford coverage or received a non-renewal letter will have few options: find an insurer willing to insure the property and pay whatever premium is asked, sell fast before current coverage ends or risk foreclosure by the lender. None are particularly desirable options.

The loss of a home due to these financial pressures is becoming a distressing reality for an increasing number of Floridians, only highlighting the urgency of addressing the insurance crisis.

Impacts on Investors, Snowbirds, and Potential Home Buyers

The increasing property insurance premiums in Florida are affecting a broad spectrum of stakeholders, including investors, part-time residents, and prospective buyers.

- Investors: High insurance costs are squeezing the profitability of rental properties, both seasonal, vacation and annual rentals. With diminished returns, many investors are rethinking their investments in Florida, potentially leading to a decreased interest in real estate ventures across the state.

- Seasonal Residents and Snowbirds: Many retirees and other seasonal residents who maintain second homes in Florida are facing escalating maintenance costs. The rising expenses are becoming prohibitively expensive, making it challenging to justify the financial burden of a Florida property under current conditions.

- Prospective Buyers: Rising insurance costs are also deterring potential buyers, who become hesitant to close on properties once they learn about the high costs associated with insuring and maintaining them. This has led to an increase in properties that are difficult to sell, creating stagnancy in the market and potentially impacting property values negatively.

This wide-reaching impact underscores the urgency for comprehensive solutions that can stabilize the insurance landscape and maintain the viability of Florida’s real estate market for all parties involved.

Navigating the Path Forward

- Legislative Reform: Policymakers are considering reforms to reduce fraudulent claims and litigation costs, though implementation will take time. Previous legislative reforms (such as Senate Bill 2D (2022) - Property Insurance) have not yielded the anticipated results.

- Risk Mitigation: Stronger building codes and encouraging hurricane-resistant upgrades can reduce risk, potentially lowering insurance costs. These stricter codes can however increase the cost to build or bring existing structures up to code.

- State Intervention: Discussions include state-backed reinsurance programs or subsidies to help homeowners afford insurance. The success of such programs depends on the details, but no serious proposal exists as of yet.

Addressing Florida’s out of control property insurance crisis requires urgent attention and a serious commitment from all stakeholders – including lawmakers, the governor and insurance companies. Floridians, seasonal residents, snowbirds and investors want comprehensive and lasting solutions that will ensure the long-term viability and affordability of property insurance in the Sunshine State.